obl-raion.ru Prices

Prices

Juicing For Two Weeks

A look at a two week juice cleanse and what happens when you go on a juice cleanse. Juice cleanse by House of Alchemy Las Vegas. Every Week, Every Two Weeks, Every Four Weeks. SUBTOTAL£0. The minimum order for delivery is £ CHECKOUT. Type of Cleanse. General Cleanses; Therapeutic. Here I share my INCREDIBLE Juice Fast Results including the amazing benefits, what juices and how much I was drinking, what juicer I use and. A week-long juice cleanse is recommended if you're an experienced, regular cleanser or if you're looking to make big lifestyle changes. These cleanses tackle. You can even mix things up with a different drink regimen each day. 2. Pick Your Duration. The Refresh — One-Day Cleanse. Quick and easy. A. Start your 2-day cleanse with the delightful juices from the “1 Day Juice Cleanse Part 1 – Juice At Home” recipe. This day focuses on juices with ingredients. It consists in drinking one juice (or smoothie), PLUS one shot every day for 14 days straight. The goal is to consume a maximum of vitamins, minerals. You can even mix things up with a different drink regimen each day. 2. Pick Your Duration. The Refresh — One-Day Cleanse. Quick and easy. A. It consists in drinking one juice (or smoothie), PLUS one shot every day for 14 days straight. The goal is to consume a maximum of vitamins, minerals. A look at a two week juice cleanse and what happens when you go on a juice cleanse. Juice cleanse by House of Alchemy Las Vegas. Every Week, Every Two Weeks, Every Four Weeks. SUBTOTAL£0. The minimum order for delivery is £ CHECKOUT. Type of Cleanse. General Cleanses; Therapeutic. Here I share my INCREDIBLE Juice Fast Results including the amazing benefits, what juices and how much I was drinking, what juicer I use and. A week-long juice cleanse is recommended if you're an experienced, regular cleanser or if you're looking to make big lifestyle changes. These cleanses tackle. You can even mix things up with a different drink regimen each day. 2. Pick Your Duration. The Refresh — One-Day Cleanse. Quick and easy. A. Start your 2-day cleanse with the delightful juices from the “1 Day Juice Cleanse Part 1 – Juice At Home” recipe. This day focuses on juices with ingredients. It consists in drinking one juice (or smoothie), PLUS one shot every day for 14 days straight. The goal is to consume a maximum of vitamins, minerals. You can even mix things up with a different drink regimen each day. 2. Pick Your Duration. The Refresh — One-Day Cleanse. Quick and easy. A. It consists in drinking one juice (or smoothie), PLUS one shot every day for 14 days straight. The goal is to consume a maximum of vitamins, minerals.

Kickstart your routine with a 2 week juice cleanse of cold-pressed juices & protein smoothies. A macro-complete cleanse. Order online now. If you're new to cleansing, this approachable option makes for a life-changing first experience. This juice cleanse includes a wide variety of appealing flavors. Which cleanse is best for me? 1Squeezed Cleanse or Super Squeezed Cleanse? Bottles 2 and 4 below depict the only difference. Kickstart your routine with a 2 week juice cleanse of cold-pressed juices & protein smoothies. A macro-complete cleanse. Order online now. Well its because juice cleanses are bullshit. Sorry to say, but they dont work. You "lost" weight because you drank all liquids for two days. If you're looking for an amazing boost in energy and vitality, the 2-day Juice Cleanse is for you. This program contains exactly what you need to take back. 14 DAY JUICE CLEANSE | JUICE CLEANSE BEFORE AND AFTER What is up you guys! I lost 10lbs on a 14 day juice cleanse. I wanted to document this. PRESS Power Week · Transform in 2 Weeks · Fab in 4 Weeks · Meal Plan Builder. Functional Meal Plans. 2 Week Skin Glow-Up. Meal Delivery Subscriptions. Healthy. Intermediate Juice Cleanse - 2 Day · Boost: Essential Green Juice ml × 2 · Lift: Sweet Green Juice ml × 2 · Fuel: Hard Green Juice ml × 2 · Shield. M views · Go to channel · MY WEIGHT LOSS JOURNEY | HOW I LOST 40 POUNDS IN 2 MONTHS. Leila Torah•M views · Go to channel. Revitalize your body with our 2 Day Detox, a refreshing blend of grapefruit juice, orange juice, lemons, and distilled water. This cleanse naturally flushes out. Add ingredients to juicer. Enjoy! Celery Pear Cucumber Green Juice. This recipe makes 2 servings. Ingredients. Two weeks of a macro-complete juice diet can help you lose weight from a juice cleanse, and spend 14 days dedicated to a total body reset. How to Choose Juice. avoid these items for up to 2 weeks after your cleanse to maintain good energy and lightness: · Caffeine · Alcohol · Refined foods (sugar, dairy, white flour. Raw Juice cleanse with Coconut Fusion made from fresh fruits and vegetables. It's great for beginners looking for an introduction to a cleanse detox. PRESS Power Week · Transform in 2 Weeks · Fab in 4 Weeks · Meal Plan Builder. Functional Meal Plans. 2 Week Skin Glow-Up. Meal Delivery Subscriptions. Healthy. 1 Day Juice Cleanse twice a week program is the most popular and intended for those that wish to maintain and enhance their healthy lifestyle. Delivery Note. You may feel hungry on the 2 days of juice fasting, but rest assured our juices will provide you with all of the nutrients your body needs to keep you energised. A Juice Cleanse helps by temporarily reducing the bodies work load, freeing up the necessary energy to begin flushing toxin build up and strengthen the immune.

Best Astrologer In Punjab

Pandit Nitin Shastri is a Well Qualified Professional astrologer Expert in Horoscope Prediction & Match Making. He has Over 15+ Years of Experience with Him. ICAS is a formal registered Apex body of top-notch astrologers of the country involved in imparting education, certification and examination of true Vedic. The most famous astrologer in Punjab is Pradip Sir Astrologer. My main health issue was addressed by Pradip astrologer last month. I contacted. Buy Best Astrologer in Punjab from GetOnlineAstrologer Find Company contact details & address in Mohali, Punjab | ID: Best Astrologer in Kapurthala - Pandit Nitin Shashtri | + Satisfied Customers | % Guaranteed Results. Award Winning Performance in Past 8 Years. Astrologer & Tarot obl-raion.ru Priya. Address: VIP Road. Zirakpur - (Punjab) India. Mobile Number: Show Number & More Information. Zirakpur within km. Popular Astrologers in Amritsar · Miyan Raza Zaidi (Blck Magic Specialist) · Monika Walia Jyotish Kendra · Pandit Shiv Kumar Jyotish · Pandit Ram Avtar Jyotishi. Why The Best: Chetan Sud-Sky Speaks, a seasoned astrologer specialising in KP, Vedic, and Lal Kitab Astrology, brings over fifteen years of expertise to his. Many astrologers are available in Jalandhar city but Pandit Desraj Ji is one of the best astrologers in Jalandhar, Punjab. He has also settled many peoples life. Pandit Nitin Shastri is a Well Qualified Professional astrologer Expert in Horoscope Prediction & Match Making. He has Over 15+ Years of Experience with Him. ICAS is a formal registered Apex body of top-notch astrologers of the country involved in imparting education, certification and examination of true Vedic. The most famous astrologer in Punjab is Pradip Sir Astrologer. My main health issue was addressed by Pradip astrologer last month. I contacted. Buy Best Astrologer in Punjab from GetOnlineAstrologer Find Company contact details & address in Mohali, Punjab | ID: Best Astrologer in Kapurthala - Pandit Nitin Shashtri | + Satisfied Customers | % Guaranteed Results. Award Winning Performance in Past 8 Years. Astrologer & Tarot obl-raion.ru Priya. Address: VIP Road. Zirakpur - (Punjab) India. Mobile Number: Show Number & More Information. Zirakpur within km. Popular Astrologers in Amritsar · Miyan Raza Zaidi (Blck Magic Specialist) · Monika Walia Jyotish Kendra · Pandit Shiv Kumar Jyotish · Pandit Ram Avtar Jyotishi. Why The Best: Chetan Sud-Sky Speaks, a seasoned astrologer specialising in KP, Vedic, and Lal Kitab Astrology, brings over fifteen years of expertise to his. Many astrologers are available in Jalandhar city but Pandit Desraj Ji is one of the best astrologers in Jalandhar, Punjab. He has also settled many peoples life.

Vishal Arora: +, Astrologer in Punjab, Best Astrologer in Punjab, Top Astrologer in Punjab, Famous Astrologer in Punjab, Jyotish in Punjab. r/punjabi - The height of Punjabis in old times! 7. upvotes · Shree Maharshi College provides the best Vastu Training Course in India at best price. And also have a lot of Astrology Books in India and provide courses. Dr. Rajan Sharma Astrologer · number: **** Inquiry For Contact · email: astrod****@obl-raion.ru · address: ludhiana, ludhiana, Punjab. KK Shastri ji, recognized as Punjab's leading famous astrologer in Punjab, has extraordinary ability in astrology & its uses. K.K. Shastri Ji has gained a. Best World famous astrologer Lalit Kumar Ji is available at + Get the astrology solution for love problem, marriage, Realationship and. Astrologer - Punjab (State) · 1 - Astro Lal Kitab - Jalandhar-east · 2 - Astrologer Anand Sharma - Mohali · 3 - Vashikaran Ex Love - Ludhiana-1 · 4 - Best. Aacharya Shri Anil Vats Ji-Astrologer. Famous Astrologer in Punjab, Best & Top Astrologer in Punjab, Astrologer in Punjab, Online Astrologer in Punjab, World No. I am Astrologer JD Shastri that is famous for helping people with best of my astrology services. I am Famous Astrologer In Punjab who always suggest the best. Astrologer offering India's Best & Top Astrologer in Punjab in Panchkula, Haryana. Get best quote and find contact details. Famous Astrologer In Nawanshahr Punjab + 46 likes · 4 talking about this. All types of problem solution specialist!!! Astrologer Dr. Meenaakshi Sharma is the best Astrology Services Provider in Punjab has Good Experience in the field of Astrology. Call at +(91) Best Astrologer in Punjab, Jalandhar, India. likes · 2 talking about this. Pandit Tarsem Sharma is one of the best Astrologer in the world who has. Best Astrologer In Punjab, Astrologer In Punjab, Top 10 Astrologer Punjab Astrosiddhi is a reputed Astrologer unit in Punjab and provides its clients with the. Astrologer offering India's Best & Top Astrologer in Punjab in Panchkula, Haryana. Get best quote and find contact details. Best Astrologer in Punjab -Astrologer obl-raion.ru Priya is Top 10 astrologer in Ludhiana For Marriage Problem Solution,Bussiness Problem solution. Thus, if you want to get immediately and safely to the vashikaran specialist in India. Likewise, Pandit Ramakant Shastri Ji is the genuine astrologer for. Top 10 Astrologers in India · 1. K. N. Rao · 2. Pt Ajai Bhambi · 3. Vijaylakshmi Krishnan · 4. Prem Kumar Sharma · 5. Anupam V. Kapil · 6. Sanjay B. Jumaani · 7. Dr. Her Track Record Made Her The Best Astrologer In Punjab, obl-raion.ru At +(91) World-famous Astrology Specialist Of Punjab. Astrologer in Punjab have always been considered as an important part of the society and even modern Indian follow astrological predictions as part of culture.

Refinance And Get Money Back

With a straight refinance, you only change the rate and term. But with a cash-out, you can change the rate, term, plus get money back. Cash-Out Refinance Rates. Federal law says that if a homeowner refinances a loan from another lender, they have 3 days to back out. This means that your lender most likely won't give you. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. The new mortgage will cover your home. If you can earn a higher return investing your money outside of your home, then you can use a cash-out refinance to free up funds to invest elsewhere. Down. Let's say you owe $, on your mortgage, and your home is currently worth $, This means you have $, in home equity. You could refinance your. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Get a call back layer. The origination. A cash out refinance lets you borrow money from your home's equity. With a cash out refinance, you replace your current mortgage with a new mortgage for a. Yes, it's possible to get a cash-out refinance on a paid-off home. It's still called a refinance even though you won't be paying off an existing mortgage. Maybe. For example, if you have a $, mortgage, you might be able to get a new mortgage for $, and receive $50, in cash back by refinancing. With. With a straight refinance, you only change the rate and term. But with a cash-out, you can change the rate, term, plus get money back. Cash-Out Refinance Rates. Federal law says that if a homeowner refinances a loan from another lender, they have 3 days to back out. This means that your lender most likely won't give you. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. The new mortgage will cover your home. If you can earn a higher return investing your money outside of your home, then you can use a cash-out refinance to free up funds to invest elsewhere. Down. Let's say you owe $, on your mortgage, and your home is currently worth $, This means you have $, in home equity. You could refinance your. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Get a call back layer. The origination. A cash out refinance lets you borrow money from your home's equity. With a cash out refinance, you replace your current mortgage with a new mortgage for a. Yes, it's possible to get a cash-out refinance on a paid-off home. It's still called a refinance even though you won't be paying off an existing mortgage. Maybe. For example, if you have a $, mortgage, you might be able to get a new mortgage for $, and receive $50, in cash back by refinancing. With.

Make the Most of Your Home Equity with Cash-Out Refinancing · Get cash to make improvements to your home, or pay off high-interest credit card debt · Refinance. The lender hands you the difference in cash, minus closing costs. You pay back the new loan over time, usually between 15 and 30 years. Your home acts as. When you use a cash-out refi, you're essentially trading in your old mortgage for a new home loan that happens to have a larger total loan amount — or at least. With a cash-out refinance, you're refinancing your mortgage for more than you currently owe. In return, you're getting a portion of your equity back in cash. You can change other terms of your mortgage when you refinance and get cash out. For example, you can change the number of years you have to pay back the loan. Federal law says that if a homeowner refinances a loan from another lender, they have 3 days to back out. This means that your lender most likely won't give you. A cash-out refinance can lower your monthly mortgage payment if current rates have dropped enough that your new, lower rate offsets borrowing more than you. In these cases, it's helpful to have a lump sum available from your refinanced mortgage. A cash-out refinance can alleviate some of the pressure associated with. Cash out refinancing is when you take out a loan worth more than your original mortgage. You use the loan to repay the original mortgage and the remaining cash. Cashout refinance means you are borrowing money and using your house as a collateral. It is not money that the mortgage company is giving you. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. Cash Back to the Borrower. As noted above, the borrower may receive a small amount of cash back in a limited cash-out refinance transaction. The lender may. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. To get cash back when you refinance, you must have equity in your vehicle, and you must also qualify for refinancing. Once you find a lender that can refinance. A cash-out refinance loan can be a good idea if you'll get a lower interest rate and you'll use the cash for college expenses or home repairs. Refinance up to 80% of the value of your home. Get cash back at closing from the equity of your home. Use the money from refinancing to help you meet your goals. Essentially, this process increases your mortgage balance, but in return, you receive a lump sum to use as you see fit. Whether for home improvements, debt. Home Improvements and Renovations – You have specific home improvement projects in mind for your house. · Eliminate other debt – Use Cash-Out Refi to pay off. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash.

Can I Take Out A Loan On My Ira

You cannot take loans out against the value of an IRA like you can with a k. There is no mechanism to do so. Upvote 4. Downvote Award. If you have to withdraw money from your account, another option to avoid the penalty is to take out a (k) loan. Although the loan must be repaid within five. IRAs do not allow account owners to borrow funds. Instead, they can withdraw or roll over funds to another qualified account or IRA or redeposited into the same. If you take it out of your account beforehand, you will lose out on any appreciation that money may accrue. You have to pay that money back within a certain. There are options available to secure the necessary funds. For example, your IRA could potentially take out a loan – known as a non-recourse loan. What is a non. Clients that utilize an eligible IRA account balance to qualify for certain discounts may qualify for one special IRA benefit package per loan. This includes an. While you can't borrow from an IRA in the traditional sense, there is a way to remove money from an IRA and then replace it within a specified period without. A non-recourse loan is a unique type of financing popular for real estate investments in IRAs where the IRA is the borrower. If you have a Roth IRA, you are always permitted to withdraw the money you've invested (your "contributions") without incurring penalties; penalties would apply. You cannot take loans out against the value of an IRA like you can with a k. There is no mechanism to do so. Upvote 4. Downvote Award. If you have to withdraw money from your account, another option to avoid the penalty is to take out a (k) loan. Although the loan must be repaid within five. IRAs do not allow account owners to borrow funds. Instead, they can withdraw or roll over funds to another qualified account or IRA or redeposited into the same. If you take it out of your account beforehand, you will lose out on any appreciation that money may accrue. You have to pay that money back within a certain. There are options available to secure the necessary funds. For example, your IRA could potentially take out a loan – known as a non-recourse loan. What is a non. Clients that utilize an eligible IRA account balance to qualify for certain discounts may qualify for one special IRA benefit package per loan. This includes an. While you can't borrow from an IRA in the traditional sense, there is a way to remove money from an IRA and then replace it within a specified period without. A non-recourse loan is a unique type of financing popular for real estate investments in IRAs where the IRA is the borrower. If you have a Roth IRA, you are always permitted to withdraw the money you've invested (your "contributions") without incurring penalties; penalties would apply.

Can I get a loan if I currently have an outstanding loan? Getting right to your question, IRA accounts cannot distribute assets as a loan and are prohibited from borrowing against the IRA assets as. Western Alliance Bank High-Yield Savings Account · Withdraw Roth IRA account contributions · Withdraw up to $10, of investment earnings from an IRA for a first. Unlike traditional loans, you can qualify for an IRA loan, even if your credit score isn't perfect. How is this possible? Simple. Your credit isn't a. Unfortunately, loans from an IRA are not permitted. However, there is an alternate option: you can withdraw funds from your IRA to purchase a home. It's vital. Can you borrow money from your IRA? Generally speaking, no, you can't take out a loan from either a traditional or Roth IRA. But there are ways to get. When you withdraw funds from your IRA, you diminish the possibility for long-term growth. This can significantly impact your retirement funds, especially if you. Using an IRA withdrawal for a home purchase is possible, but there are rules. Discover the pros and cons of an IRA withdrawal to buy a home. If you have a Money Market account with Principal Bank and are 59 ½ or older, you can order checks for your account and withdraw money at any time (up to 6. You can take either a home loan or a general purpose loan. General loans must be repaid within five years, while home loans can be repaid within 15 years. No, you cannot borrow against a Traditional or Roth IRA. Self-directed IRAs do not allow self-loans or loans to disqualified persons. You may withdraw funds. No, you absolutely cannot borrow from your IRA, nor can you use the IRA as security for a loan from someplace else (eg, a bank or a broker). With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Anyone who has at least % of the purchase price vested in a self-directed IRA has the opportunity to buy rental properties using a non-recourse loan. This. * You will have to pay ordinary income taxes on a withdrawal amount (unless from your Roth account), and a 10% early withdrawal penalty if you take the. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. Neither Roth nor traditional IRAs allow you to take loans, but you can access money from an IRA for a day period through a "tax-free rollover" if you put the. You can withdraw the amount needed to cover the emergency, which could be up to your entire vested balance. When you apply for the withdrawal, you need to show. If you're under 59½, you may get hit with both ordinary income taxes and an additional 10% federal income tax. What's more, you could miss out on years of. While an IRA may use leverage in certain conventional asset environments, it is quite unusual to be able to do so. Real estate as an asset class is better.

How To Read Candlestick Charts For Beginners

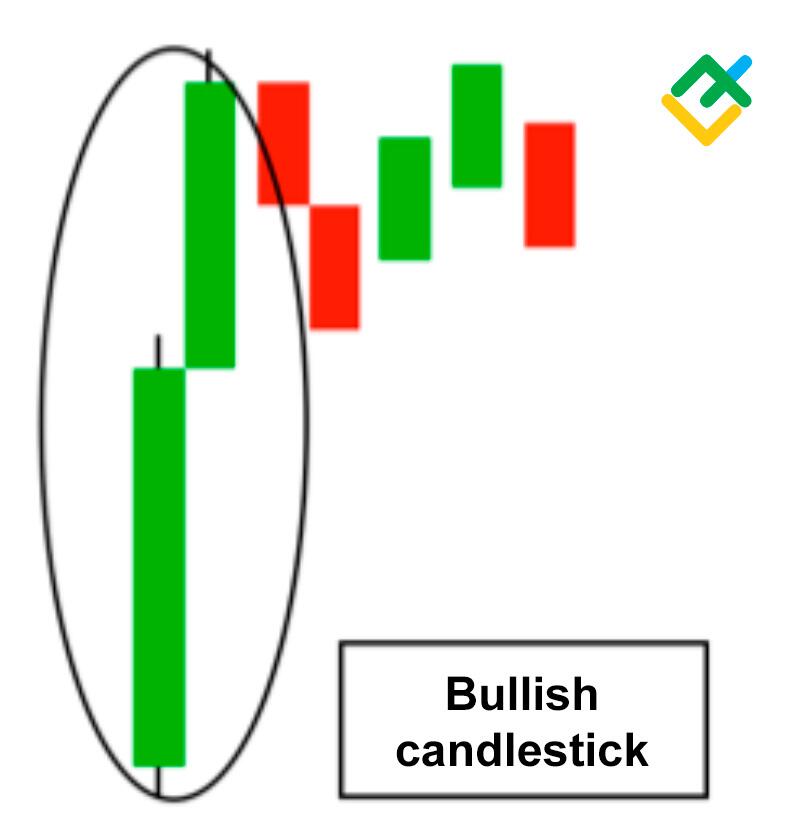

Each candlestick shows the open price, low price, high price, and close price of a market for a particular period of time. Patterns emerging on candlestick. Unlike conventional line charts, candlestick charts encapsulate a wealth of information within each candle, presenting the open, high, low, and. Green candles show prices going up, so the open is at the bottom of the body and the close is at the top. Red candles show prices declining, so the open is at. Use a candlestick chart to show the low, high, opening, and closing values of a security for a specific period. Candlestick Charts display multiple bits of price information such as the open price, close price, highest price and lowest price through the use of candlestick. charts more, Thank you again for sharing the good There are literally a websites and videos on the basics of reading candlesticks. Candlestick Charting For Dummies sheds light on this time-tested method for finding the perfect moment to buy or sell. It demystifies technical and chart. The chart analysis can be interpreted by individual candles and their patterns. Bullish candlestick patterns may be used to initiate long trades, whereas. If the close of the day is below the open, the body of the rectangle is red. Candlesticks can show whether the buyer or seller has control of the market. Where. Each candlestick shows the open price, low price, high price, and close price of a market for a particular period of time. Patterns emerging on candlestick. Unlike conventional line charts, candlestick charts encapsulate a wealth of information within each candle, presenting the open, high, low, and. Green candles show prices going up, so the open is at the bottom of the body and the close is at the top. Red candles show prices declining, so the open is at. Use a candlestick chart to show the low, high, opening, and closing values of a security for a specific period. Candlestick Charts display multiple bits of price information such as the open price, close price, highest price and lowest price through the use of candlestick. charts more, Thank you again for sharing the good There are literally a websites and videos on the basics of reading candlesticks. Candlestick Charting For Dummies sheds light on this time-tested method for finding the perfect moment to buy or sell. It demystifies technical and chart. The chart analysis can be interpreted by individual candles and their patterns. Bullish candlestick patterns may be used to initiate long trades, whereas. If the close of the day is below the open, the body of the rectangle is red. Candlesticks can show whether the buyer or seller has control of the market. Where.

Candlestick charts plot price over time. The vertical axis on the chart represents the price or the exchange rate between two currencies. It is a compact, clear way to illustrate price points and trends. how to read candlestick charts. This candlestick chart illustrates Ether's daily price history. However, candlesticks often form patterns that investors use for analysis or traders use to assess trading strategies. There are many candlestick patterns, but. How to Read Candlestick Charts? Green candles indicate that the closing price for a particular asset was higher than its opening price, while a red candle. There are four data points in every candlestick: the open, high, low and close. The open is the very first trade for the specific period and the close is the. They contain the same data as a standard bar chart but highlight the relationship between opening and closing prices. The narrow stick shows the price range . What is a candle chart? A chart showing the changing prices of a financial product, which looks like a candle in shape. Read our definition to learn more. The chart consists of individual “candlesticks” that show the opening, closing, high, and low prices each day for the market they represent over a period of. The chart is represented by rectangle blocks with vertical lines at the top and the bottom, resembling a candle and its wick. Understanding candlestick charts. Candlestick patterns simply show you the open high low and close in the market. If you are looking at the daily timeframe candlestick chart It shows you the. The most basic skill needed for investing is the ability to read a stock chart and then understand how that data can aid your investing success. Candlestick charts are a Japanese way of reading price action. Candlesticks were initially used for trading rice in the s and onwards. They are available. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. You can develop your skills in a risk-. In this chart scenario, the most recent candle, completely engulfs the previous one and both wicks of the previous one are covered by this new one. This action. A candlestick chart is a graphical representation used in financial analysis to display the price movement of an asset. It consists of individual. The way to read a candlestick chart is simple. There are only four data points displayed. The four data points are the Open, Close, High and Low. These four. Step by step tutorial to learn how to read a Hollow Candlesticks chart, and how to create an interactive Hollow candlesticks chart with Highcharts Stock. Candle charts. Japanese Candlesticks offer the most popular form of charting. The candle chart bears much more information than the line chart and it is. How to Read a Single Candlestick Each candlestick represents one day's worth of price data about a stock through four pieces of information: the opening price. A style of financial chart used to describe price movements of a security, derivative, or currency. Scheme of a single candlestick chart.

Top Ten High Yield Savings Accounts

The better earning potential makes HYSAs a great option for storing your emergency funds or savings for various short-term goals, like a new car, a future. Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Best High-Yield Savings Accounts of September Up to % · SoFi Checking and Savings · CIT Bank Platinum Savings. The High-Yield Online Savings account is perfect if you want a convenient online account that earns a great rate. With a minimum of $ to open you'll be. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. GOBankingRates named Sallie Mae as one of the top online banks, recognizing its products' high interest rate and no monthly fees. More features of our High-. Regular savings account. Ally is great. Reply reply. The highest interest rate on savings accounts will be offshore in emerging countries. The good news is that emerging countries will require lower minimum. Best High-Yield Savings Accounts – August · Top High-Yield Savings Accounts · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - The better earning potential makes HYSAs a great option for storing your emergency funds or savings for various short-term goals, like a new car, a future. Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Best High-Yield Savings Accounts of September Up to % · SoFi Checking and Savings · CIT Bank Platinum Savings. The High-Yield Online Savings account is perfect if you want a convenient online account that earns a great rate. With a minimum of $ to open you'll be. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. GOBankingRates named Sallie Mae as one of the top online banks, recognizing its products' high interest rate and no monthly fees. More features of our High-. Regular savings account. Ally is great. Reply reply. The highest interest rate on savings accounts will be offshore in emerging countries. The good news is that emerging countries will require lower minimum. Best High-Yield Savings Accounts – August · Top High-Yield Savings Accounts · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One -

Open your % APY* Connect High-Yield Checking account for as little as $1, and get access to great Debit rewards, with free ATM access nationwide, free. At SCCU, our highest paying high-yield savings account is SCCU Saving Cents, which is a round-up savings program where debit card transactions are rounded up to. A high yield savings account is a great way to grow your money over the long term. First Bank has several options for those searching for the highest yield. Great news, our new website is here! For your convenience, we will continue to keep the current site up before we fully migrate to the new site. Our picks at a glance · My Banking Direct High Yield Savings · Varo Savings Account · UFB Direct High Yield Savings · EverBank Performance Savings · Laurel Road High. CDs may be a good choice if you have some money in savings that you're unlikely to need right away. They offer a higher interest rate than a traditional savings. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ If you want to earn the maximum amount on your savings, you might consider opening an account at Simplii Financial. This online bank is currently promoting and. High-yield savings account rates · Best high-yield savings accounts for September · Quontic Bank Savings Account · Varo Bank Online Savings Account · Upgrade. Online savings accounts Higher savings rates are back You'll find some of the best savings rates out there - right here ; % APY. High Yield Savings Account. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. This combination of a high interest rate and limited conditions makes EQ Bank one of the top recommended best high-interest savings accounts in Canada. Best. The Poppy Bank Premier Online Savings account is our best overall pick because it offers a % APY regardless of the amount you deposit. With $1, minimum. Helpful articles about money, life, and innovation. Benefits of saving for medium-term goals. It's a good idea to get in. High Yield Savings Account. Get a great rate on your savings along with total flexibility! See other Savings Accounts Open an account online! *Annual. The interest rates on high-yield savings accounts can be 10 to 12 times higher than traditional savings account returns. The highest rates are often available. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! NATIONAL AVERAGE: National Average APYs are based on specific product types of top 50 U.S. banks (ranked by total deposits) provided by Curinos LLC as of 8/01/. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Finding the best savings account to grow your money is crucial. After all, saving money is a key part of your financial security and financial future.

Monthly Income Etf Portfolio

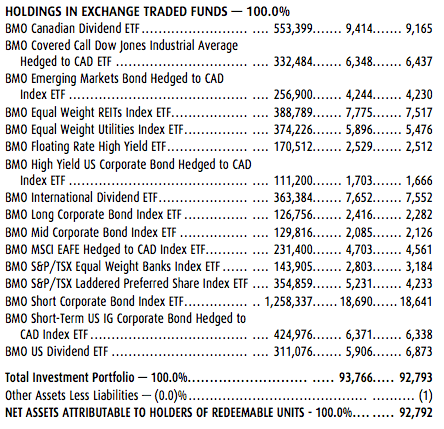

Fidelity Canadian Monthly High Income ETF ; Net assets $M ; Units outstanding , ; Management fee % ; MER * % ; Investment program. DRIP. Our ETF lineup helps asset allocators re-imagine their core equity holdings with convexity, directly and efficiently hedge portfolios against rising interest. The iShares Diversified Monthly Income ETF seeks to provide a consistent monthly cash distribution, with the potential for modest long-term capital growth. The BlackRock Flexible Income ETF seeks to maximize long-term income by primarily investing in debt and income-producing securities with a secondary objective. Conservative portfolio that invests mostly in fixed income ETFs and to a lesser extent in equity ETFs with an emphasis on capital preservation. Seeks a steady. In allocating the portfolio, the Manager will consider average market valuations across regions, sectors and asset classes, relative economic conditions that. Seeks maximum current income consistent with preservation of capital and prudent investment management. Primary Portfolio. Primarily non-Canadian dollar Fixed. Balanced Income. A smart 60/40 mix of Equity Income and Fixed Income ETFs for monthly income and growth with tactical allocation. Explore Balanced Income. Seeks a steady income stream with some growth potential. Diversification that strives to deliver lower volatility. Fidelity Canadian Monthly High Income ETF ; Net assets $M ; Units outstanding , ; Management fee % ; MER * % ; Investment program. DRIP. Our ETF lineup helps asset allocators re-imagine their core equity holdings with convexity, directly and efficiently hedge portfolios against rising interest. The iShares Diversified Monthly Income ETF seeks to provide a consistent monthly cash distribution, with the potential for modest long-term capital growth. The BlackRock Flexible Income ETF seeks to maximize long-term income by primarily investing in debt and income-producing securities with a secondary objective. Conservative portfolio that invests mostly in fixed income ETFs and to a lesser extent in equity ETFs with an emphasis on capital preservation. Seeks a steady. In allocating the portfolio, the Manager will consider average market valuations across regions, sectors and asset classes, relative economic conditions that. Seeks maximum current income consistent with preservation of capital and prudent investment management. Primary Portfolio. Primarily non-Canadian dollar Fixed. Balanced Income. A smart 60/40 mix of Equity Income and Fixed Income ETFs for monthly income and growth with tactical allocation. Explore Balanced Income. Seeks a steady income stream with some growth potential. Diversification that strives to deliver lower volatility.

Schedule monthly income from dividend stocks with a monthly payment frequency. Model portfolio targeting % dividend yield. MLPs ››. Master Limited. Fidelity Global Monthly High Income ETF Fund ; NAV $ -$ / %. Aug ; Aggregate assets (all series) $M · Jul ; MER* %. Mar-. The fund seeks to achieve high income and long-term capital growth by investing in a portfolio of mutual funds (including ETFs) that are managed by the. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Harvest Diversified Monthly Income ETF (HDIF) holds a portfolio of high income ETFs to deliver attractive yield paid as monthly cashflow. Summary ; iShares 10+ Year Investment Grade Corporate Bond ETF, IGLB, % ; SPDR Portfolio Long Term Corporate Bond ETF, SPLB, % ; iShares MBS ETF, MBB, Sustainability Characteristics can help investors integrate non-financial, sustainability considerations into their investment process. Vanguard Retirement Income ETF Portfolio seeks to provide a combination of consistent income Monthly, quarterly, annual, and cumulative performance is also. Vanguard Retirement Income ETF Portfolio seeks to provide a combination of consistent income with the possibility of some capital appreciation by investing. The Nationwide Nasdaq ® Risk Managed Income ETF seeks to provide investors with: · High monthly income generation · Portfolio volatility reduction · A measure. ZMI Portfolio - Learn more about the BMO Monthly Income ETF investment portfolio including asset allocation, stock style, stock holdings and more. The ETF seeks to provide monthly cash distributions, with the potential for modest long-term capital appreciation, generally by investing in BMO ETFs that. BMO Monthly Income ETF TSX. Morningstar Medalist Rating™. Performance; Analysis; Sustainability; Risk; Price; Portfolio; Parent. Add To Portfolio. Related. FTSM Logo, First Trust Enhanced Short Maturity ETF ; SRLN Logo, SPDR Blackstone Senior Loan ETF ; BLV Logo, Vanguard Long-Term Bond Index Fund ETF ; The Simplify Enhanced Income ETF (HIGH) seeks to provide monthly income by selling short-dated put and/or call spreads on a variety of equity and fixed. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF . ETF strategies that look beyond traditional fixed income, offering solutions for investors seeking to increase or diversify the yield potential of their. The NEOS Nasdaq High Income ETF (the “Fund”) seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation. All NEOS ETFs Aim to Generate Tax-Efficient Monthly Income Across Core Portfolio Exposures · SPYI. NEOS S&P ® High Income ETF · BNDI. NEOS Enhanced Income. ZMI Portfolio - Learn more about the BMO Monthly Income ETF investment portfolio including asset allocation, stock style, stock holdings and more.

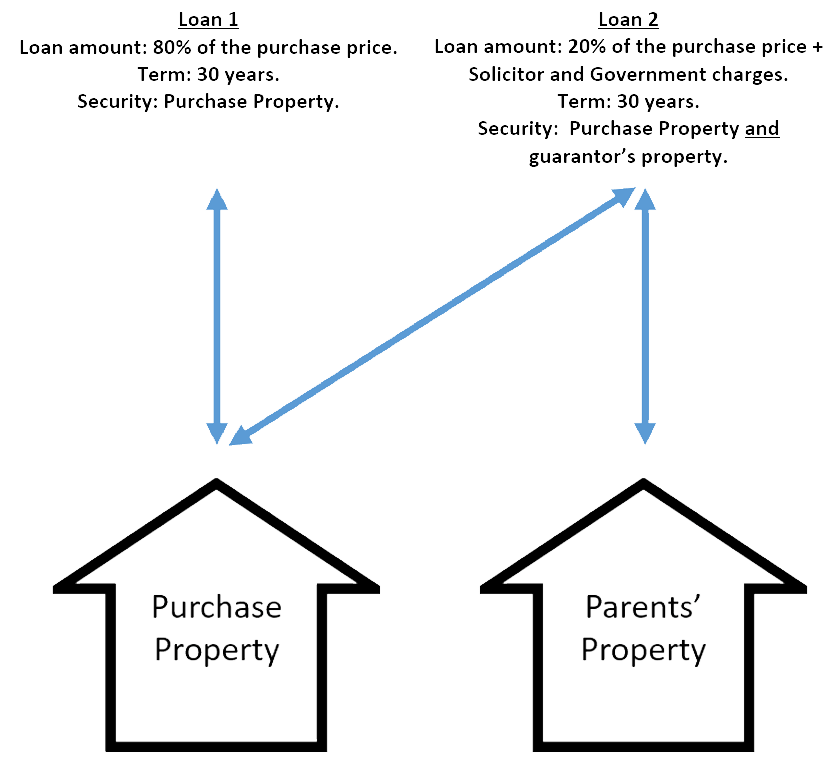

Mortgage Loan Guarantor

If you guarantee a loan for a family member or friend, you're known as the guarantor. You are responsible for paying back the entire loan if the borrower can't. You're a guarantor if you put your name down on a mortgage for a family member or a friend. You're accountable for paying the mortgage if the borrower can't. If. Types of guarantor home loans · Family or parent guarantee. This type of guarantor loan is primarily designed for parents of the home buyer to act as guarantors. A guarantor loan is an unsecured borrowing loan taken out with someone else – usually a family member. These loans typically carry higher interest rates. They'. A co-borrower is someone borrowing money with you. They can support your application for our financing solutions. The co-borrower also agrees to repay the debt. It's an unsecured loan in which the 'guarantor' promises to repay the debt if the borrower can't meet the repayments. The interest rate can be higher than a. For manually underwritten loans, if the income of a guarantor, co-signer, or non-occupant borrower is used for qualifying purposes, the occupying borrower(s). A guarantor mortgage is where another person acts as a guarantor by allowing their home or savings to be used as collateral for the loan. If the borrower runs. If a borrower fails to meet the eligibility benchmark of a Loan Against Property, introducing a mortgage loan guarantor may help their case. This is. If you guarantee a loan for a family member or friend, you're known as the guarantor. You are responsible for paying back the entire loan if the borrower can't. You're a guarantor if you put your name down on a mortgage for a family member or a friend. You're accountable for paying the mortgage if the borrower can't. If. Types of guarantor home loans · Family or parent guarantee. This type of guarantor loan is primarily designed for parents of the home buyer to act as guarantors. A guarantor loan is an unsecured borrowing loan taken out with someone else – usually a family member. These loans typically carry higher interest rates. They'. A co-borrower is someone borrowing money with you. They can support your application for our financing solutions. The co-borrower also agrees to repay the debt. It's an unsecured loan in which the 'guarantor' promises to repay the debt if the borrower can't meet the repayments. The interest rate can be higher than a. For manually underwritten loans, if the income of a guarantor, co-signer, or non-occupant borrower is used for qualifying purposes, the occupying borrower(s). A guarantor mortgage is where another person acts as a guarantor by allowing their home or savings to be used as collateral for the loan. If the borrower runs. If a borrower fails to meet the eligibility benchmark of a Loan Against Property, introducing a mortgage loan guarantor may help their case. This is.

Guarantor mortgages are for people who might struggle to get a mortgage, or to borrow as much as they'd like to get their dream home. So, they're suited for. Guarantor mortgages can be obtained under whole loan or shortfall agreements. If your guarantor agrees to cover the whole of your loan, they will need to prove. Mortgage. Each guarantor agrees that, if the Mortgagor defaults in making any payment or in performing any other obligation under the. Mortgage, the guarantor. (n). We, us and our mean __[insert name of mortgagee]______, the financial institution making the Loan described in the Mortgage; Guarantor, each Guarantor is. What does a guarantor on a mortgage do? · A guarantor on a mortgage is the person who provides the additional security for your home loan. · Your guarantor. As a guarantor, you only become responsible for the debt if the borrower defaults on an obligation. For example, by missing a loan payment. The lender must ask. Yes. Being a guarantor on someone else's mortgage will be taken into consideration by the bank when you apply for a mortgage. Theoretically it. A lender will usually carry out a credit check on them before accepting them as your guarantor. The better their credit history, the more credible they'll look. Meet all GuarantorGuarantorKey Principal or other Person executing a Payment Guaranty, Non-Recourse Guaranty, or any other Mortgage Loan guaranty. requirements. A guarantor loan is a loan that has a third party with it to help the primary borrower get funding despite low income and poor credit. Apply Now. A guarantor. Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you “guarantee” someone else's loan or. How Does A Guarantor Work For A Home Loan? ✓A guarantor home loan forgoes the requirement for a deposit in place of your parents property. A guarantor on a loan is a person who takes responsibility for repaying the loan if the borrower fails to do so. · Guarantors, usually U.S. citizens or permanent. Acting as guarantor for a borrower means you agree to repay the home loan if the borrower can't meet the repayment terms and conditions of their loan contract. In essence, being a guarantor means helping another party or individual access credit, such as a loan or even a mortgage. The lender bases their decision to. Guarantor mortgages. A guarantor mortgage is for customers who don't have enough income to qualify for a mortgage on their own. The guarantor provides a. Enhanced contribution guarantor. Where a borrower is looking to purchase a property that they would not be able to afford from their own income, other family. Fixed-Rate Guarantor execution allows you to maximize your origination fee income and increase your servicing portfolio. Through this execution in Loan. This means if you don't pay your debt, it falls to the family member to pay it. The family member guaranteeing payment of the home loan is known as a 'guarantor. This means that if the borrower stops paying the loan, the guarantor will need to make the repayments on some, or all of the loan. The loan guarantor must be.

Making Basement Into Bedroom

1. Measure Your Basement. You'll want to know just how much space you're working with. · 2. Inspect Existing Construction Quality · 3. Install Insulation and. If your basement is a big enough room for multi-use, you could install a door to separate your utility room from the rest of the space. Sliding doors make a. 1. Use a simple floor plan · 2. Use moisture and mildew resistant materials · 3. Install a drop ceiling · 4. Creatively hide pipes, ducts, and HVAC or water. interlocking foam mats. and installed them along my entire basement floor. I then bought a few large area rugs to go over. the foam mats to make it feel more. Well for it to be a bedroom you need to put an egress window in, that's the had part the framing and drywall is standard and easy. In this comprehensive guide, we'll walk you through the essential elements you need to consider to meet basement code requirements and make your basement. Half of the basement turned into a master bedroom. Just a couple things to be added. #homeproject #diy #homeiprovement #black #gray #basement #masterbedroom. Can I turn my existing cellar into a bedroom? Yes, you absolutely can. A lot of households resort to their cellars when they need an extra room because their. Danford, Brewer & Ives has years of experience converting basements into bedrooms, and our expert team is here to help you through every step of the process. 1. Measure Your Basement. You'll want to know just how much space you're working with. · 2. Inspect Existing Construction Quality · 3. Install Insulation and. If your basement is a big enough room for multi-use, you could install a door to separate your utility room from the rest of the space. Sliding doors make a. 1. Use a simple floor plan · 2. Use moisture and mildew resistant materials · 3. Install a drop ceiling · 4. Creatively hide pipes, ducts, and HVAC or water. interlocking foam mats. and installed them along my entire basement floor. I then bought a few large area rugs to go over. the foam mats to make it feel more. Well for it to be a bedroom you need to put an egress window in, that's the had part the framing and drywall is standard and easy. In this comprehensive guide, we'll walk you through the essential elements you need to consider to meet basement code requirements and make your basement. Half of the basement turned into a master bedroom. Just a couple things to be added. #homeproject #diy #homeiprovement #black #gray #basement #masterbedroom. Can I turn my existing cellar into a bedroom? Yes, you absolutely can. A lot of households resort to their cellars when they need an extra room because their. Danford, Brewer & Ives has years of experience converting basements into bedrooms, and our expert team is here to help you through every step of the process.

From Drab to Fab:The Comprehensive Guide to Basement Remodeling · 1. Lighting Can Make All the Difference · 2. Prioritize High-Quality Insulation · 3. Choose. Supplement your income by turning your unused basement space into a rental unit. Bedroom with Wood Trimmed Wall. One effective layout approach is to position the bed against a wall with a window, which can provide ample natural light and create the illusion of a larger. This significantly enhances the sense of space, making the room appear larger than it actually is. To visually increase the size of a basement bedroom. “Thick down-filled comforters and pillows coupled with a fitted bed skirt and pillow shams will elevate the room from lower level to upper end.” More: Making. In short, yes. You can use your basement as a bedroom, but you have to ensure that it complies with the proper building codes. Basement living spaces require an. If you are creating a bedroom, the egress window or door must be within the bedroom itself. Egress windows shall provide square feet of openable area, with. That's not to say it's impossible, but it does require a lot more work and money to turn a basement into an apartment. Many homes simply do not offer enough. The problem was how to transform this space into a lovely bedroom retreat for them? How to create an inexpensive bedroom in an unfinished basement. This is. To make a room feel soothing, nothing works better than a neutral color palette. The simple hues of white, grey, and beige, not only brighten. A common hurdle that basement conversions have is that the bedroom or living space must have an exterior egress no more than 44 inches from the floor (usually a. No Sew Tie Up Shades · Roman Shades Diy · Tie Up Curtains ; Seattle family lives small, but with meaning · Cheap Window Treatments · Classy Room ; a simple curtain. In Maryland, a basement egress window must have a minimum opening area of sq. feet with minimum opening height and width 24× No Sew Tie Up Shades · Roman Shades Diy · Tie Up Curtains ; Seattle family lives small, but with meaning · Cheap Window Treatments · Classy Room ; a simple curtain. You should try to bring in as much natural light as possible. A walk-out basement can have glass doors or doors with windows. Egress windows and window wells. If you're a Seattle area homeowner and want to add additional bedrooms without paying for a home addition, consider converting some of your basement space into. Basement Finishing: This involves adding drywall, flooring, and lighting to create a livable space, often used as a family room or home office. · Bedroom. Due to the dark nature of basements, it is important that you focus on lighting when designing your basement guest suite, as the right lighting can help your. From Drab to Fab:The Comprehensive Guide to Basement Remodeling · 1. Lighting Can Make All the Difference · 2. Prioritize High-Quality Insulation · 3. Choose. Danford, Brewer & Ives has years of experience converting basements into bedrooms, and our expert team is here to help you through every step of the process.

What Age Can I Invest In Stocks

You can buy stock at any age. If you're under 18, you must do so through a custodial account set up with a guardian. After the age of 18, you can open an. Similarly, for a TFSA, you'll need to be 18 years of age regardless of where you live in Canada. Parents can help their tweens and teens learn to invest by. How old do you have to be to invest in stocks on your own? If you are under 18, you cannot own stocks, mutual funds, and other financial assets outright. As. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. There are no age restrictions on investing. It is true that you generally need to be at least 18 years old to open your own brokerage account. This advice is great. Invest in a fund, rather than trying to stock pick. At 18 you have time for your account to grow and a funds return can be. That's because trading stocks and other types of assets requires a type of contract, and minors can't sign contracts. However, unlike other age-restricted. You can only begin investing at In fact, most brokers have '18 and above' as their age restriction when setting up an account. You need to be 18 to buy stocks in every state in the nation (and in most it's 21!). However, you can still get started early if you have the time and know. You can buy stock at any age. If you're under 18, you must do so through a custodial account set up with a guardian. After the age of 18, you can open an. Similarly, for a TFSA, you'll need to be 18 years of age regardless of where you live in Canada. Parents can help their tweens and teens learn to invest by. How old do you have to be to invest in stocks on your own? If you are under 18, you cannot own stocks, mutual funds, and other financial assets outright. As. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. There are no age restrictions on investing. It is true that you generally need to be at least 18 years old to open your own brokerage account. This advice is great. Invest in a fund, rather than trying to stock pick. At 18 you have time for your account to grow and a funds return can be. That's because trading stocks and other types of assets requires a type of contract, and minors can't sign contracts. However, unlike other age-restricted. You can only begin investing at In fact, most brokers have '18 and above' as their age restriction when setting up an account. You need to be 18 to buy stocks in every state in the nation (and in most it's 21!). However, you can still get started early if you have the time and know.

Yes, as per SEBI guidelines, you can open a trading/Demat account for your minor child with any registered broker in India. However, it has to be operated by. Financial planners typically advise people to shift investments away from stocks and toward bonds as they age. The planners commonly justify this advice in. Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. You must be at least 18 years old to invest in the stock market. Anyone younger will need an adult to do it for them. Custodial Accounts for Teen Investors How old do you have to be to invest in stocks on your own? If you are under 18, you cannot own stocks, mutual funds, and. Legally to invest in stocks in your own Demat A/c. You must be 18 years old. An you must have PAN card to open a Demat account. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. The old rule of thumb used to be that you should subtract your age from - and that's the percentage of your portfolio that you should keep in stocks. The custodian can make contributions and invest that money into stocks, bonds or mutual funds to grow the account balance. Other family members can also make. Pros—Flexibility. Anyone age 18 or older can open one. · Cons—Taxes. While a brokerage account may be the simplest to open and start using, it's typically the. Generally speaking, investors should expect to be at least 18, but some young investors may have to wait until their 21st birthday before they can make their. Investing in stocks. Investing in individual stocks can be tempting. · Investing in mutual and index funds · Investing in a retirement account · Investing in a. A year-old making investments that yield a can usually be received through a portfolio that's stock heavy. Keep in mind that when investing in stocks. You can only begin investing at In fact, most brokers have '18 and above' as their age restriction when setting up an account. In turn, this can influence the way you allocate your portfolio among stocks, bonds, cash, and other investments. Tips for improving your portfolio mix. Yes you can, take permission from your parents first, because there is a risk involved in market, risk of losing money and you have to. A brokerage account is a standard nonretirement investing account. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because. A year-old making investments that yield a can usually be received through a portfolio that's stock heavy. Keep in mind that when investing in stocks. How to buy stocks. You can buy or sell stocks by opening a brokerage account through a financial services firm. Your financial advisor can help you get started.